Discover the best nomad insurance options for long-term travelers. Focus on coverage duration, flexibility, and affordability. Stay protected on your extended adventures.

Why Long-Term Nomad Insurance Matters

So, you're planning a long-term adventure? Awesome! But before you pack your bags and chase the sunset, let's talk about something crucial: nomad insurance. Think of it as your safety net while you're exploring the world. Regular travel insurance is great for short trips, but it's not designed for the unique challenges and extended durations of a nomadic lifestyle. Long-term nomad insurance gives you continuous coverage, access to medical care worldwide, and peace of mind knowing you're protected from unexpected events.

Key Features to Look for in Long-Term Nomad Insurance

Not all nomad insurance is created equal. When you're planning a long-term trip, you need to consider some key factors:

- Coverage Duration: Make sure the policy can cover the entire length of your trip. Some policies have maximum coverage periods, so choose one that suits your needs.

- Geographic Coverage: Where are you planning to travel? Ensure the policy covers all the countries on your itinerary. Some policies exclude certain regions or have different coverage levels depending on the location.

- Medical Coverage: This is the big one. Look for comprehensive medical coverage, including emergency medical care, hospitalization, surgery, and repatriation (getting you back home in case of a serious medical emergency).

- Emergency Evacuation: What happens if you need to be evacuated from a remote location? A good policy will cover the costs of emergency evacuation to the nearest appropriate medical facility.

- Personal Liability: What if you accidentally injure someone or damage their property? Personal liability coverage can protect you from financial losses in these situations.

- Pre-existing Conditions: If you have any pre-existing medical conditions, check how the policy handles them. Some policies may exclude coverage for pre-existing conditions, while others may offer limited coverage.

- Activities Coverage: Are you planning on doing any adventurous activities like hiking, scuba diving, or rock climbing? Make sure the policy covers these activities. Some policies exclude coverage for certain high-risk activities.

- 24/7 Support: You want to be able to reach someone for help at any time, day or night. Look for a policy that offers 24/7 customer support.

- Flexibility: Nomad life is unpredictable. Choose a policy that allows you to adjust your coverage as your plans change. Can you extend your coverage if you decide to stay longer in a certain country? Can you cancel your policy if you need to return home early?

- Affordability: Of course, price is a factor. But don't just choose the cheapest policy. Make sure you're getting adequate coverage for your needs.

Top Nomad Insurance Providers for Extended Adventures

Okay, let's get down to the nitty-gritty. Here are some of the top nomad insurance providers for long-term travelers, keeping in mind the features we just discussed:

SafetyWing Nomad Insurance: A Popular Choice for Digital Nomads

SafetyWing is a popular option among digital nomads because of its affordability and flexibility. It's a subscription-based model, so you pay a monthly fee and can cancel anytime. It covers medical expenses, travel delays, and lost luggage. However, it's crucial to understand its limitations. It's designed more as a travel medical insurance than a comprehensive health insurance.

SafetyWing Nomad Insurance: Key Features and Usage Scenarios

- Coverage: Medical expenses, some travel delays, lost luggage.

- Pros: Affordable, flexible subscription model, easy to use.

- Cons: Limited coverage compared to other options, not suitable for pre-existing conditions, may not cover all adventure activities.

- Ideal For: Digital nomads who are generally healthy and need basic medical coverage. Those who want a flexible and affordable option.

- Usage Scenario: You're working remotely from Southeast Asia and need basic medical coverage in case of an accident or illness.

- Price: Starting around $45 per month (prices vary based on age and coverage area).

World Nomads Travel Insurance: Adventure-Focused Coverage

World Nomads is known for its adventure-focused coverage. They offer different levels of coverage depending on your activities. It's a good option if you're planning on doing a lot of hiking, scuba diving, or other adventurous activities. Be mindful that while they cover a wide range of activities, their prices can be higher than other options.

World Nomads Travel Insurance: Key Features and Usage Scenarios

- Coverage: Medical expenses, trip cancellation, lost luggage, adventure activities.

- Pros: Comprehensive coverage, covers a wide range of adventure activities, good customer service.

- Cons: Can be more expensive than other options, pre-existing conditions may not be covered.

- Ideal For: Adventurous travelers who need comprehensive coverage for a variety of activities.

- Usage Scenario: You're backpacking through South America and plan on hiking in the Andes Mountains.

- Price: Varies significantly based on coverage level, duration, and activities (expect to pay $100-$300+ per month).

Cigna Global Expat Insurance: Comprehensive Global Healthcare

Cigna Global offers comprehensive global healthcare coverage. It's a more expensive option, but it provides a higher level of coverage than SafetyWing or World Nomads. It's a good option if you want the most comprehensive protection possible. It is a true expat insurance, meaning it is designed for those living abroad for extended periods, offering broader coverage than travel insurance.

Cigna Global Expat Insurance: Key Features and Usage Scenarios

- Coverage: Comprehensive medical coverage, including hospitalization, surgery, and specialist care.

- Pros: Very comprehensive coverage, access to a global network of healthcare providers, customizable plans.

- Cons: Expensive, can be complex to understand.

- Ideal For: Expats who want the most comprehensive healthcare coverage possible. Those with pre-existing conditions may find better coverage here.

- Usage Scenario: You're living and working in Europe for several years and want comprehensive healthcare coverage.

- Price: Significantly higher than other options (expect to pay $200-$500+ per month, depending on coverage level).

IMG Global Medical Insurance: A Solid Mid-Range Option

IMG Global Medical Insurance offers a solid mid-range option. It provides good coverage at a more reasonable price than Cigna Global. They have a variety of plans to choose from, so you can find one that fits your needs and budget. It balances cost and coverage effectively.

IMG Global Medical Insurance: Key Features and Usage Scenarios

- Coverage: Good medical coverage, including hospitalization and emergency care.

- Pros: Good balance of cost and coverage, a variety of plans to choose from.

- Cons: Coverage may not be as comprehensive as Cigna Global.

- Ideal For: Expats and long-term travelers who want good coverage at a reasonable price.

- Usage Scenario: You're teaching English in Asia for a year and want good medical coverage without breaking the bank.

- Price: Moderate price range (expect to pay $100-$300+ per month, depending on coverage level).

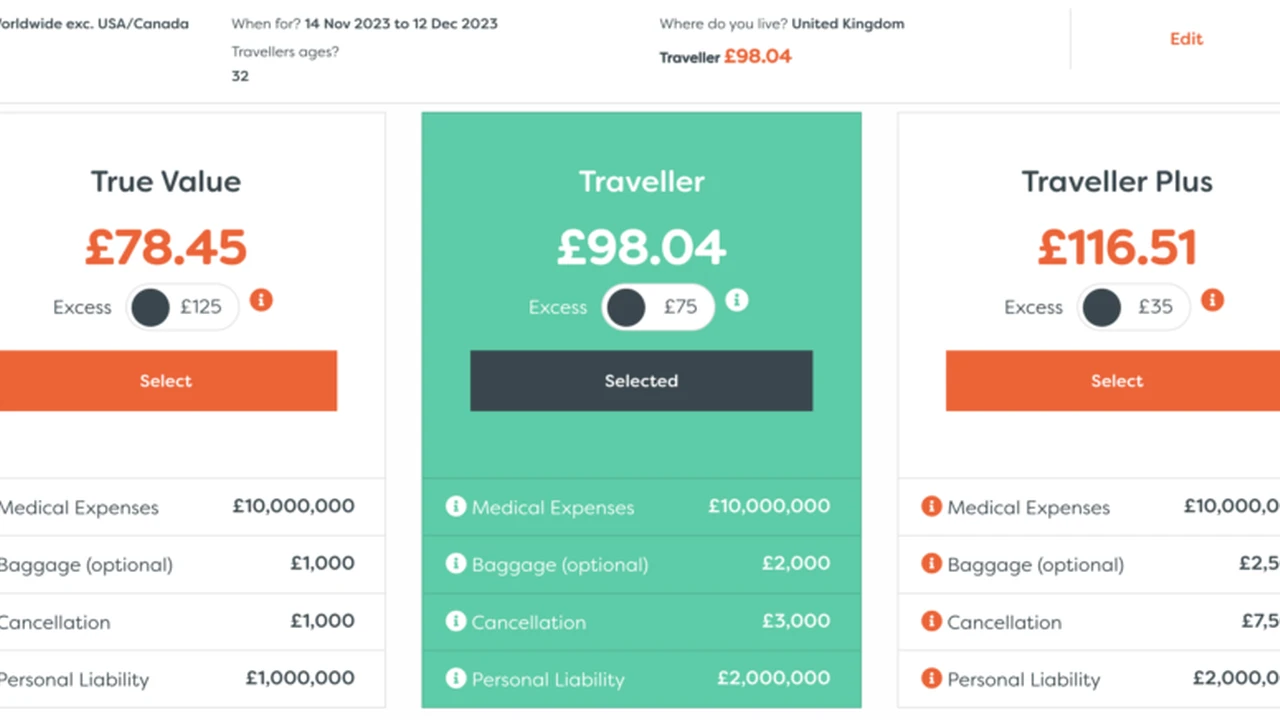

Comparing Nomad Insurance Plans: Side-by-Side

Let's break down a quick comparison table to help you visualize the differences:

| Provider | Price | Coverage | Flexibility | Best For |

|---|---|---|---|---|

| SafetyWing | Low | Basic Medical | High | Budget-conscious digital nomads |

| World Nomads | Moderate to High | Comprehensive, Adventure | Moderate | Adventurous travelers |

| Cigna Global | High | Very Comprehensive | Moderate | Expats needing top-tier healthcare |

| IMG Global | Moderate | Good Medical | Moderate | Balanced coverage and cost |

Nomad Insurance Product Recommendations

Here are a few specific nomad insurance product recommendations, based on different needs and budgets:

- For Budget Travelers: SafetyWing Nomad Insurance. It's the most affordable option and provides basic medical coverage.

- For Adventure Seekers: World Nomads Explorer Plan. It covers a wide range of adventure activities.

- For Comprehensive Coverage: Cigna Global Platinum Plan. It offers the most comprehensive coverage available.

- For a Balanced Approach: IMG Global Medical Insurance Gold Plan. It provides good coverage at a reasonable price.

Making the Right Choice for Your Long-Term Trip

Choosing the right nomad insurance for your long-term trip is a personal decision. Consider your budget, your travel style, your activities, and your medical needs. Read the fine print of each policy and make sure you understand what's covered and what's not. Don't hesitate to contact the insurance provider directly with any questions. Investing in good nomad insurance is an investment in your health, safety, and peace of mind. Happy travels!

AI-Assisted Content Disclaimer

This article was created with AI assistance and reviewed by a human for accuracy and clarity.